Sales Tax Compliance

Dave’s Bookkeeping and Tax Service has partnered with Avalara to run your sales tax more effectively.

WHO benefits most from sales tax automation?

Companies that have a high level of business complexity including:

- A large amount of SKUs or products

- A high volume of transactions

- Selling into multiple states or internationally

- High volume of exempt sales

- Acquiring or merging with another company

- Expanding into new locations

- Beginning to sell online or internationally

- Adding new products or services

Companies where their go-to-market strategy includes:

- Selling to wholesale, distribution, resale customers or not-for-profits.

- Remote employees or field sales

- Attending tradeshows

- Dropping shipping and third-party fulfillment or distribution

- Warehouses or inventory in multiple states

- Affiliate marketing

When is it a great time to talk about tax compliance?

If your company is experiencing change, it’s a great time to talk about sales tax. This includes:

- Executive or staff changes such as a new CFO, Controller or finance manager

- Changes to the company structure or undergoing a significant reorganization

- Implementing a new ERP, ecommerce or accounting system

- Current financial platform is nearing end-of-life or requires an upgrade

- Going through an audit or getting a notice of an upcoming audit

Why it makes sense to automate sales tax management

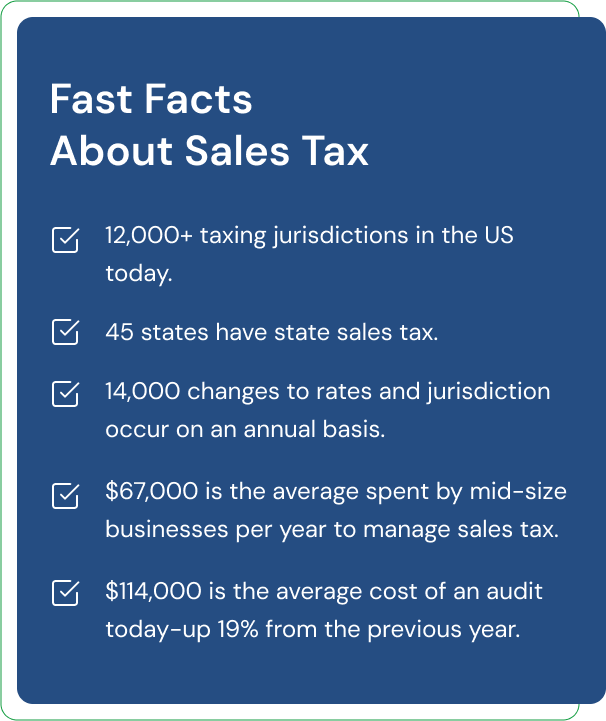

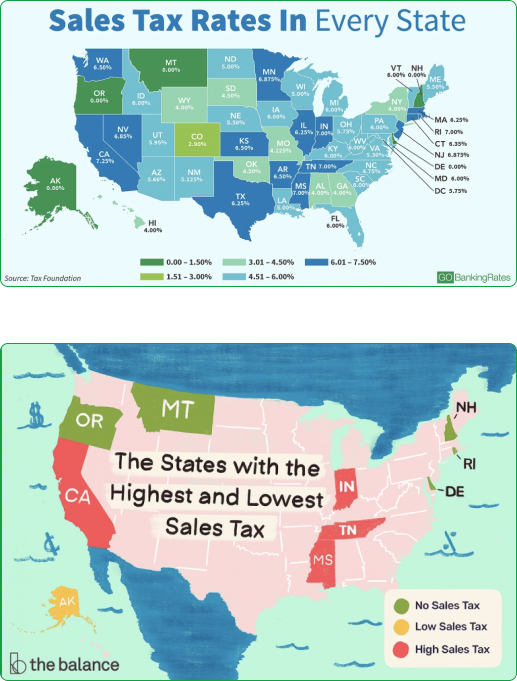

- Sales tax is complex. There are more than 12,000 taxing jurisdiction in the U.S. Each of the 45 states that collects sales tax has different rules and regulations around what and how products and services are taxed or exempted from sales tax.

- The rules are constantly changing. Legislative changes take place on a regular basis and there’s a great deal of variance state to state regarding sales and use tax. On average, there are more than 14,000 changes to tax rates and rules happening every year.

- It’s a drain on company resources. Handling sales tax in-house can take up a significant amount of your staff’s time. In fact, the average small to mid-size company spends $67,000 a year in employee costs to manage sales tax. For larger companies, this is closer to $400,000.

- It’s a high-risk activity. It’s very easy to make an error or overlook a tax obligation. While seemingly innocuous, getting it wrong can end up costing you a substantial amount if the state finds you out of compliance.

- Automating sales tax can reduce the amount of time, money and risk that impact your business related to compliance-related activities.

- Eliminates the tedious work and complexity that goes into manually calculating and reporting sales taxes.

- Improves transactional tax accuracy to dramatically reduces their risk of costly negative audit results

- Provides a scalable and affordable means to outsource a tedious activity that doesn’t add value to their business and has a high rate of error and risk when handled internally.

How Avalara’s

Technology Works?

Ease of Use

Avalara’s products are cloud-based Software-as-a-Service solutions. No more costly on-premise software, hardware or licenses to upgrade, renew or maintain. Tax rates, rules and boundaries are managed in the Cloud, ensuring up-to-date accuracy and real-time delivery, so there’s no rate tables to upload or software to update.

Fast deployment

Pre-certified integrations to 300+ ERP, ecommerce and accounting systems means you can get up and running quickly. Avoid disruptions to your business from lengthy or complex installations or deployments.

Secure, real-time data transfer

For any quote, order or invoice data, the financial/accounting system communicates with our technology over a secure connection with transactional data. The tax information is returned directly to your financial/accounting system in less than a second.

Robust data capture & reporting

No need to research tax rates, build tax tables or make tax decisions in the order entry process. Once an invoice is posted the information is captured in a robust database/ reporting engines.

Fast reconciliation

Instead of running reports and filling out forms, cutting checks and mailing multiple tax payments, our customers simply reconcile a single monthly worksheet and pay one amount for their total tax obligation.

- How are you currently managing sales tax?

- Manually: How much time would you say your staff spend dealing with sales tax?

- In your ERP/accounting system: Are you using standard software or a third-party solution?

- Do you currently outsource other compliance activities such as payroll?

- Do you know all the states in which you are required to collect and remit tax and file returns?

- Are you familiar with all the activities that can create nexus—a connection to a state that creates a sales tax obligation?

- Are you concerned about an audit or have you been audited before? If yes, how did it go?

- Have you ever considered options to automate or outsource sales tax?

- Did you know that your ERP/Ecommerce/Accounting System provider has an integration to our software to automate sales tax compliance?